Marketing

Are Your Customer Acquisition Costs Correct?

Are Your Customer Acquisition Costs Correct?

2016-11-27

Marketing

Are Your Customer Acquisition Costs Correct?

2016-11-27

Marketing

Are Your Customer Acquisition Costs Correct?

2016-11-27

The single most important metric that a SaaS company can track is customer acquisition costs (known as CAC). If you aren’t calculating CAC right, or worse, not even calculating it, it’s absolutely vital that you take time to understand this. If you’re acquiring customers at a drastically unsustainable cost, your business is bound to fail.

The more precise you can get on your awareness of your CAC, the easier it will be for you to scheme up ways to generate more profit for your company. Once you’ve calculated your CAC, it will be considered healthy if it’s three times less than your customer lifetime value. Meaning that if it costs you $25 to acquire a new user, you should be able to generate at least $75 of revenue from the user during their lifetime as a customer of yours.

Companies that miscalculate CAC with skewed numbers are making a potentially dangerous mistake. The wrong CAC number leads to incorrect ad spending and incorrect growth planning. It will steer you incorrectly on your path towards monetization. You can’t afford to miscalculate your customer acquisition costs.

The single most important metric that a SaaS company can track is customer acquisition costs (known as CAC). If you aren’t calculating CAC right, or worse, not even calculating it, it’s absolutely vital that you take time to understand this. If you’re acquiring customers at a drastically unsustainable cost, your business is bound to fail.

The more precise you can get on your awareness of your CAC, the easier it will be for you to scheme up ways to generate more profit for your company. Once you’ve calculated your CAC, it will be considered healthy if it’s three times less than your customer lifetime value. Meaning that if it costs you $25 to acquire a new user, you should be able to generate at least $75 of revenue from the user during their lifetime as a customer of yours.

Companies that miscalculate CAC with skewed numbers are making a potentially dangerous mistake. The wrong CAC number leads to incorrect ad spending and incorrect growth planning. It will steer you incorrectly on your path towards monetization. You can’t afford to miscalculate your customer acquisition costs.

The single most important metric that a SaaS company can track is customer acquisition costs (known as CAC). If you aren’t calculating CAC right, or worse, not even calculating it, it’s absolutely vital that you take time to understand this. If you’re acquiring customers at a drastically unsustainable cost, your business is bound to fail.

The more precise you can get on your awareness of your CAC, the easier it will be for you to scheme up ways to generate more profit for your company. Once you’ve calculated your CAC, it will be considered healthy if it’s three times less than your customer lifetime value. Meaning that if it costs you $25 to acquire a new user, you should be able to generate at least $75 of revenue from the user during their lifetime as a customer of yours.

Companies that miscalculate CAC with skewed numbers are making a potentially dangerous mistake. The wrong CAC number leads to incorrect ad spending and incorrect growth planning. It will steer you incorrectly on your path towards monetization. You can’t afford to miscalculate your customer acquisition costs.

The single most important metric that a SaaS company can track is customer acquisition costs (known as CAC). If you aren’t calculating CAC right, or worse, not even calculating it, it’s absolutely vital that you take time to understand this. If you’re acquiring customers at a drastically unsustainable cost, your business is bound to fail.

The more precise you can get on your awareness of your CAC, the easier it will be for you to scheme up ways to generate more profit for your company. Once you’ve calculated your CAC, it will be considered healthy if it’s three times less than your customer lifetime value. Meaning that if it costs you $25 to acquire a new user, you should be able to generate at least $75 of revenue from the user during their lifetime as a customer of yours.

Companies that miscalculate CAC with skewed numbers are making a potentially dangerous mistake. The wrong CAC number leads to incorrect ad spending and incorrect growth planning. It will steer you incorrectly on your path towards monetization. You can’t afford to miscalculate your customer acquisition costs.

Table of Contents

Auto Generated TOC

Auto Generated TOC

Auto Generated TOC

Auto Generated TOC

How to make sure you’re calculating customer acquisition costs correctly:

Before we really start digging in, we want to note that this article is aimed at SaaS startups. This is because they require a lot more capital to get started. However, the lessons we’re sharing are useful for any business owner or marketer who wants to make sure their business is growing sustainably.

Since we are focusing on SaaS companies, it’s great to remember that total revenue from each customer is likely going to come from a subscription. When revenue comes from a subscription, this means that not all revenue is going to be immediately seen by the business. The amount of time that it takes for a SaaS company to return money spent on custom acquisition include:

Amount Spent to Acquire the Customer. When you first acquire a new customer, they’re simply paying back your cost to acquire them. Once a customer has paid back the amount you spent to acquire them, you’ve started to generate profit.

The Way You Monetize Your Customers. Monetizing your customers means giving them offerings at exactly the right pricing. You need to have customers give you enough money where you can generate profit, while being in a zone that leaves customers feeling like they’re getting value for what you offer. With this in mind, make sure you’re not picking random prices for your product. Ask customers what they expect to pay for a product like yours.

How Long Are Customers Staying Customers? If your customers are staying and paying for your product for a long time, their lifetime value (LTV) will be higher and you’ll be able to come up with ways to extract additional revenue from each of these customers.

The three bullets above are all a great reminder that the goal of a SaaS company is to have the period in which a customer pays you back for your costs to acquire them be as short as possible.

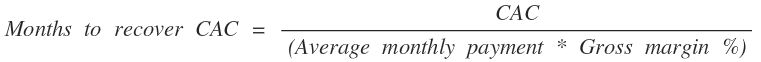

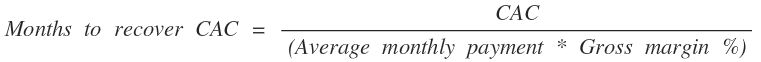

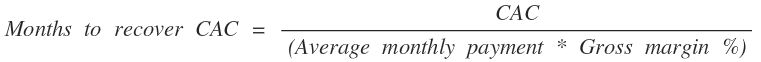

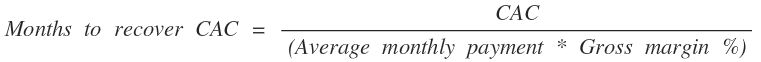

To get a more firm understanding on this, we recommend calculating your months to CAC payback. You can do this with the formula below:

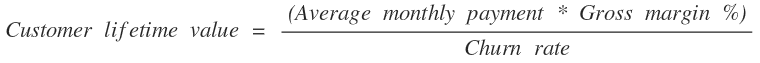

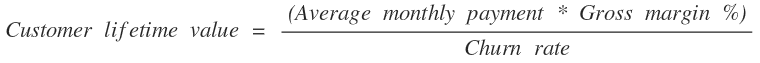

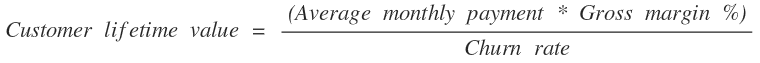

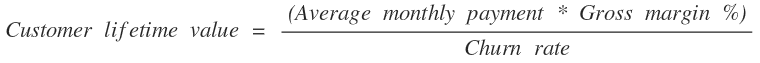

Once you know how long it takes to get paid back, you’ll want to compare this to your customer lifetime value (LTV). To calculate your LTV, you follow the formula below:

As we mentioned earlier, you’ll want your lifetime value (LTV) customer acquisition costs (CAC) to be 3:1. You want your customer acquisition cost to be 1/3rd of the amount of the lifetime value of a customer.

To really drive this notion home, let’s go through a hypothetical example of the formulas above in action, with an imaginary company.

The company, which we will call GloboWorld, earns an average of $3,000 per customer, per month. They have a gross margin of 70% and their cost to acquire a new customer is $8,400. Each month, 5% of GloboWorld’s customers churn. This leaves the average lifetime value of a customer at $42,000. GloboWorld has has a LTV to CAC ratio of 5 (nice job, GloboWorld!) and it takes them only 4 months to recover the amount that they spent to acquire their new customer.

In our example company above, GloboWorld has a very healthy business. In just four months they are getting the money that they spent to acquire a new customer back. Once they recover their CAC, they can reinvest money back into their business to help accelerate its growth. This company has the potential to grow very fast.

This example does a great job reminding us the importance of monetization. The more efficiently you can monetize your customers and create value for them, the faster your company will grow.

Common Customer Acquisition Cost Mistakes:

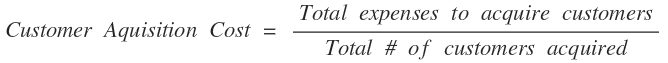

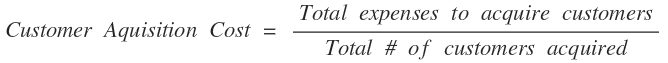

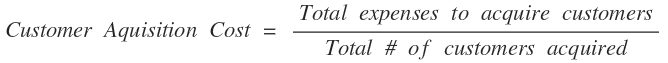

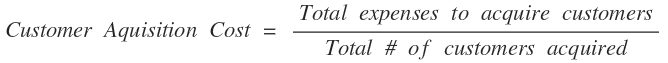

The customer acquisition cost formula is pretty simple. It is the following:

Because this formula is so simple, it makes it a lot easier to make an error. We are going to look at four common errors that companies make when calculating their customer acquisition cost.

CAC MISTAKE #1: Thinking paid acquisition is the only advertising expense. You have more expenses than that. All marketing costs count as a customer acquisition expense.

CAC MISTAKE #2: Forgetting to include every single marketing cost you have. If you don’t include costs related to SEO, content marketing, lead scoring, data enrichment, web hosting, and similar, you are calculating an incorrect CAC.

CAC MISTAKE #3: If you forget to include the salary of all customer acquisition-related employees, you’re calculating CAC wrong. Make sure you’re including sales team members and salaries of marketing managers when calculating your customer acquisition costs.

CAC MISTAKE #4: If you are counting new accounts that aren’t paying as acquired customers, you’re making a huge mistake. Users who are not paying and are in free trials are not customers. They aren’t customers because they haven’t committed to anything. Calculating CAC with non-paying customers will radically skew your numbers incorrectly. Free users are not customers and should not be included in your CAC calculations.

The four mistakes above show how a simple error can throw off your entire CAC calculation and steer your business in the wrong direction. The details matter when it comes to calculating CAC, so make sure you’re paying attention to everything and thinking though all costs your business incurs to acquire a new customer.

[et_pb_cta _builder_version="3.4.1" title="LeadBoxer can help you reduce your CAC" button_text="Start Now !" button_url="/signup" custom_button="on" button_text_size="22" button_bg_color="#0082c6" button_bg_color_hover="#153f91" body_font_size="18"]

Get more insight into online users and behaviour, turn your data into customers.

[/et_pb_cta]

How to make sure you’re calculating customer acquisition costs correctly:

Before we really start digging in, we want to note that this article is aimed at SaaS startups. This is because they require a lot more capital to get started. However, the lessons we’re sharing are useful for any business owner or marketer who wants to make sure their business is growing sustainably.

Since we are focusing on SaaS companies, it’s great to remember that total revenue from each customer is likely going to come from a subscription. When revenue comes from a subscription, this means that not all revenue is going to be immediately seen by the business. The amount of time that it takes for a SaaS company to return money spent on custom acquisition include:

Amount Spent to Acquire the Customer. When you first acquire a new customer, they’re simply paying back your cost to acquire them. Once a customer has paid back the amount you spent to acquire them, you’ve started to generate profit.

The Way You Monetize Your Customers. Monetizing your customers means giving them offerings at exactly the right pricing. You need to have customers give you enough money where you can generate profit, while being in a zone that leaves customers feeling like they’re getting value for what you offer. With this in mind, make sure you’re not picking random prices for your product. Ask customers what they expect to pay for a product like yours.

How Long Are Customers Staying Customers? If your customers are staying and paying for your product for a long time, their lifetime value (LTV) will be higher and you’ll be able to come up with ways to extract additional revenue from each of these customers.

The three bullets above are all a great reminder that the goal of a SaaS company is to have the period in which a customer pays you back for your costs to acquire them be as short as possible.

To get a more firm understanding on this, we recommend calculating your months to CAC payback. You can do this with the formula below:

Once you know how long it takes to get paid back, you’ll want to compare this to your customer lifetime value (LTV). To calculate your LTV, you follow the formula below:

As we mentioned earlier, you’ll want your lifetime value (LTV) customer acquisition costs (CAC) to be 3:1. You want your customer acquisition cost to be 1/3rd of the amount of the lifetime value of a customer.

To really drive this notion home, let’s go through a hypothetical example of the formulas above in action, with an imaginary company.

The company, which we will call GloboWorld, earns an average of $3,000 per customer, per month. They have a gross margin of 70% and their cost to acquire a new customer is $8,400. Each month, 5% of GloboWorld’s customers churn. This leaves the average lifetime value of a customer at $42,000. GloboWorld has has a LTV to CAC ratio of 5 (nice job, GloboWorld!) and it takes them only 4 months to recover the amount that they spent to acquire their new customer.

In our example company above, GloboWorld has a very healthy business. In just four months they are getting the money that they spent to acquire a new customer back. Once they recover their CAC, they can reinvest money back into their business to help accelerate its growth. This company has the potential to grow very fast.

This example does a great job reminding us the importance of monetization. The more efficiently you can monetize your customers and create value for them, the faster your company will grow.

Common Customer Acquisition Cost Mistakes:

The customer acquisition cost formula is pretty simple. It is the following:

Because this formula is so simple, it makes it a lot easier to make an error. We are going to look at four common errors that companies make when calculating their customer acquisition cost.

CAC MISTAKE #1: Thinking paid acquisition is the only advertising expense. You have more expenses than that. All marketing costs count as a customer acquisition expense.

CAC MISTAKE #2: Forgetting to include every single marketing cost you have. If you don’t include costs related to SEO, content marketing, lead scoring, data enrichment, web hosting, and similar, you are calculating an incorrect CAC.

CAC MISTAKE #3: If you forget to include the salary of all customer acquisition-related employees, you’re calculating CAC wrong. Make sure you’re including sales team members and salaries of marketing managers when calculating your customer acquisition costs.

CAC MISTAKE #4: If you are counting new accounts that aren’t paying as acquired customers, you’re making a huge mistake. Users who are not paying and are in free trials are not customers. They aren’t customers because they haven’t committed to anything. Calculating CAC with non-paying customers will radically skew your numbers incorrectly. Free users are not customers and should not be included in your CAC calculations.

The four mistakes above show how a simple error can throw off your entire CAC calculation and steer your business in the wrong direction. The details matter when it comes to calculating CAC, so make sure you’re paying attention to everything and thinking though all costs your business incurs to acquire a new customer.

[et_pb_cta _builder_version="3.4.1" title="LeadBoxer can help you reduce your CAC" button_text="Start Now !" button_url="/signup" custom_button="on" button_text_size="22" button_bg_color="#0082c6" button_bg_color_hover="#153f91" body_font_size="18"]

Get more insight into online users and behaviour, turn your data into customers.

[/et_pb_cta]

How to make sure you’re calculating customer acquisition costs correctly:

Before we really start digging in, we want to note that this article is aimed at SaaS startups. This is because they require a lot more capital to get started. However, the lessons we’re sharing are useful for any business owner or marketer who wants to make sure their business is growing sustainably.

Since we are focusing on SaaS companies, it’s great to remember that total revenue from each customer is likely going to come from a subscription. When revenue comes from a subscription, this means that not all revenue is going to be immediately seen by the business. The amount of time that it takes for a SaaS company to return money spent on custom acquisition include:

Amount Spent to Acquire the Customer. When you first acquire a new customer, they’re simply paying back your cost to acquire them. Once a customer has paid back the amount you spent to acquire them, you’ve started to generate profit.

The Way You Monetize Your Customers. Monetizing your customers means giving them offerings at exactly the right pricing. You need to have customers give you enough money where you can generate profit, while being in a zone that leaves customers feeling like they’re getting value for what you offer. With this in mind, make sure you’re not picking random prices for your product. Ask customers what they expect to pay for a product like yours.

How Long Are Customers Staying Customers? If your customers are staying and paying for your product for a long time, their lifetime value (LTV) will be higher and you’ll be able to come up with ways to extract additional revenue from each of these customers.

The three bullets above are all a great reminder that the goal of a SaaS company is to have the period in which a customer pays you back for your costs to acquire them be as short as possible.

To get a more firm understanding on this, we recommend calculating your months to CAC payback. You can do this with the formula below:

Once you know how long it takes to get paid back, you’ll want to compare this to your customer lifetime value (LTV). To calculate your LTV, you follow the formula below:

As we mentioned earlier, you’ll want your lifetime value (LTV) customer acquisition costs (CAC) to be 3:1. You want your customer acquisition cost to be 1/3rd of the amount of the lifetime value of a customer.

To really drive this notion home, let’s go through a hypothetical example of the formulas above in action, with an imaginary company.

The company, which we will call GloboWorld, earns an average of $3,000 per customer, per month. They have a gross margin of 70% and their cost to acquire a new customer is $8,400. Each month, 5% of GloboWorld’s customers churn. This leaves the average lifetime value of a customer at $42,000. GloboWorld has has a LTV to CAC ratio of 5 (nice job, GloboWorld!) and it takes them only 4 months to recover the amount that they spent to acquire their new customer.

In our example company above, GloboWorld has a very healthy business. In just four months they are getting the money that they spent to acquire a new customer back. Once they recover their CAC, they can reinvest money back into their business to help accelerate its growth. This company has the potential to grow very fast.

This example does a great job reminding us the importance of monetization. The more efficiently you can monetize your customers and create value for them, the faster your company will grow.

Common Customer Acquisition Cost Mistakes:

The customer acquisition cost formula is pretty simple. It is the following:

Because this formula is so simple, it makes it a lot easier to make an error. We are going to look at four common errors that companies make when calculating their customer acquisition cost.

CAC MISTAKE #1: Thinking paid acquisition is the only advertising expense. You have more expenses than that. All marketing costs count as a customer acquisition expense.

CAC MISTAKE #2: Forgetting to include every single marketing cost you have. If you don’t include costs related to SEO, content marketing, lead scoring, data enrichment, web hosting, and similar, you are calculating an incorrect CAC.

CAC MISTAKE #3: If you forget to include the salary of all customer acquisition-related employees, you’re calculating CAC wrong. Make sure you’re including sales team members and salaries of marketing managers when calculating your customer acquisition costs.

CAC MISTAKE #4: If you are counting new accounts that aren’t paying as acquired customers, you’re making a huge mistake. Users who are not paying and are in free trials are not customers. They aren’t customers because they haven’t committed to anything. Calculating CAC with non-paying customers will radically skew your numbers incorrectly. Free users are not customers and should not be included in your CAC calculations.

The four mistakes above show how a simple error can throw off your entire CAC calculation and steer your business in the wrong direction. The details matter when it comes to calculating CAC, so make sure you’re paying attention to everything and thinking though all costs your business incurs to acquire a new customer.

[et_pb_cta _builder_version="3.4.1" title="LeadBoxer can help you reduce your CAC" button_text="Start Now !" button_url="/signup" custom_button="on" button_text_size="22" button_bg_color="#0082c6" button_bg_color_hover="#153f91" body_font_size="18"]

Get more insight into online users and behaviour, turn your data into customers.

[/et_pb_cta]

How to make sure you’re calculating customer acquisition costs correctly:

Before we really start digging in, we want to note that this article is aimed at SaaS startups. This is because they require a lot more capital to get started. However, the lessons we’re sharing are useful for any business owner or marketer who wants to make sure their business is growing sustainably.

Since we are focusing on SaaS companies, it’s great to remember that total revenue from each customer is likely going to come from a subscription. When revenue comes from a subscription, this means that not all revenue is going to be immediately seen by the business. The amount of time that it takes for a SaaS company to return money spent on custom acquisition include:

Amount Spent to Acquire the Customer. When you first acquire a new customer, they’re simply paying back your cost to acquire them. Once a customer has paid back the amount you spent to acquire them, you’ve started to generate profit.

The Way You Monetize Your Customers. Monetizing your customers means giving them offerings at exactly the right pricing. You need to have customers give you enough money where you can generate profit, while being in a zone that leaves customers feeling like they’re getting value for what you offer. With this in mind, make sure you’re not picking random prices for your product. Ask customers what they expect to pay for a product like yours.

How Long Are Customers Staying Customers? If your customers are staying and paying for your product for a long time, their lifetime value (LTV) will be higher and you’ll be able to come up with ways to extract additional revenue from each of these customers.

The three bullets above are all a great reminder that the goal of a SaaS company is to have the period in which a customer pays you back for your costs to acquire them be as short as possible.

To get a more firm understanding on this, we recommend calculating your months to CAC payback. You can do this with the formula below:

Once you know how long it takes to get paid back, you’ll want to compare this to your customer lifetime value (LTV). To calculate your LTV, you follow the formula below:

As we mentioned earlier, you’ll want your lifetime value (LTV) customer acquisition costs (CAC) to be 3:1. You want your customer acquisition cost to be 1/3rd of the amount of the lifetime value of a customer.

To really drive this notion home, let’s go through a hypothetical example of the formulas above in action, with an imaginary company.

The company, which we will call GloboWorld, earns an average of $3,000 per customer, per month. They have a gross margin of 70% and their cost to acquire a new customer is $8,400. Each month, 5% of GloboWorld’s customers churn. This leaves the average lifetime value of a customer at $42,000. GloboWorld has has a LTV to CAC ratio of 5 (nice job, GloboWorld!) and it takes them only 4 months to recover the amount that they spent to acquire their new customer.

In our example company above, GloboWorld has a very healthy business. In just four months they are getting the money that they spent to acquire a new customer back. Once they recover their CAC, they can reinvest money back into their business to help accelerate its growth. This company has the potential to grow very fast.

This example does a great job reminding us the importance of monetization. The more efficiently you can monetize your customers and create value for them, the faster your company will grow.

Common Customer Acquisition Cost Mistakes:

The customer acquisition cost formula is pretty simple. It is the following:

Because this formula is so simple, it makes it a lot easier to make an error. We are going to look at four common errors that companies make when calculating their customer acquisition cost.

CAC MISTAKE #1: Thinking paid acquisition is the only advertising expense. You have more expenses than that. All marketing costs count as a customer acquisition expense.

CAC MISTAKE #2: Forgetting to include every single marketing cost you have. If you don’t include costs related to SEO, content marketing, lead scoring, data enrichment, web hosting, and similar, you are calculating an incorrect CAC.

CAC MISTAKE #3: If you forget to include the salary of all customer acquisition-related employees, you’re calculating CAC wrong. Make sure you’re including sales team members and salaries of marketing managers when calculating your customer acquisition costs.

CAC MISTAKE #4: If you are counting new accounts that aren’t paying as acquired customers, you’re making a huge mistake. Users who are not paying and are in free trials are not customers. They aren’t customers because they haven’t committed to anything. Calculating CAC with non-paying customers will radically skew your numbers incorrectly. Free users are not customers and should not be included in your CAC calculations.

The four mistakes above show how a simple error can throw off your entire CAC calculation and steer your business in the wrong direction. The details matter when it comes to calculating CAC, so make sure you’re paying attention to everything and thinking though all costs your business incurs to acquire a new customer.

[et_pb_cta _builder_version="3.4.1" title="LeadBoxer can help you reduce your CAC" button_text="Start Now !" button_url="/signup" custom_button="on" button_text_size="22" button_bg_color="#0082c6" button_bg_color_hover="#153f91" body_font_size="18"]

Get more insight into online users and behaviour, turn your data into customers.

[/et_pb_cta]

Generate More Qualified Leads with LeadBoxer

Create a (free) account or get a demo and find out how we can help you.

Generate More Qualified Leads with LeadBoxer

Create a (free) account or get a demo and find out how we can help you.

Generate More Qualified Leads with LeadBoxer

Create a (free) account or get a demo and find out how we can help you.

Generate More Qualified Leads with LeadBoxer

Create a (free) account or get a demo and find out how we can help you.

Get Started with LeadBoxer

LeadBoxer can help you quickly generate more leads

Get more insight into your online audience and their behaviour, and turn this data into actual opportunities.

Start Now!

Get Started with LeadBoxer

LeadBoxer can help you quickly generate more leads

Get more insight into your online audience and their behaviour, and turn this data into actual opportunities.

Start Now!

Get Started with LeadBoxer

LeadBoxer can help you quickly generate more leads

Get more insight into your online audience and their behaviour, and turn this data into actual opportunities.

Start Now!

Get Started with LeadBoxer

LeadBoxer can help you quickly generate more leads

Get more insight into your online audience and their behaviour, and turn this data into actual opportunities.

Start Now!

Other content in category

Marketing

B2B Content Syndication: Why Experts Predict It Will Trend in 2025

The Importance of Targeted Sales Enablement Content and Metrics

Prioritizing Conversion Rate Optimization

The Importance of Brand Positioning and Brand Value

Growth Hacking Versus Growth Marketing: The Pros and Cons

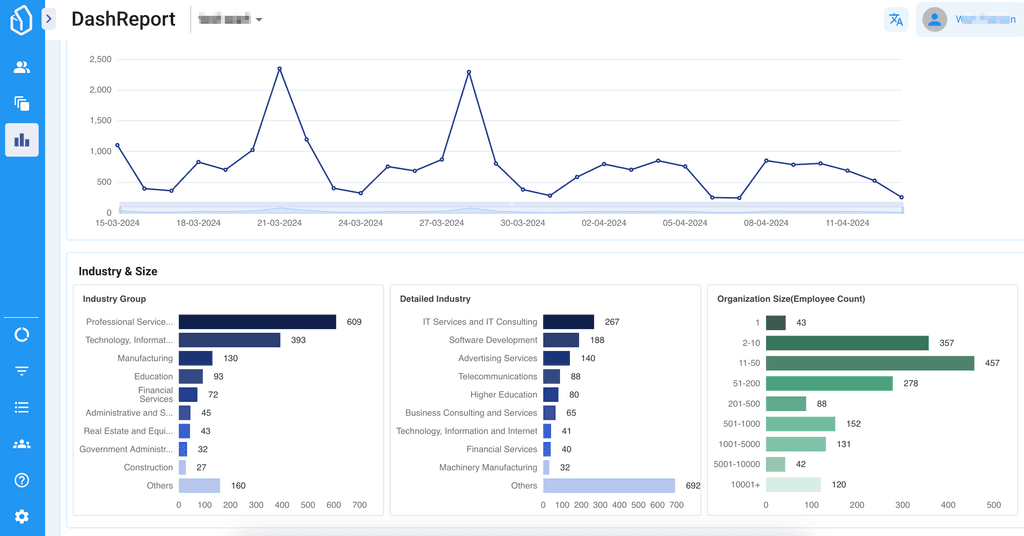

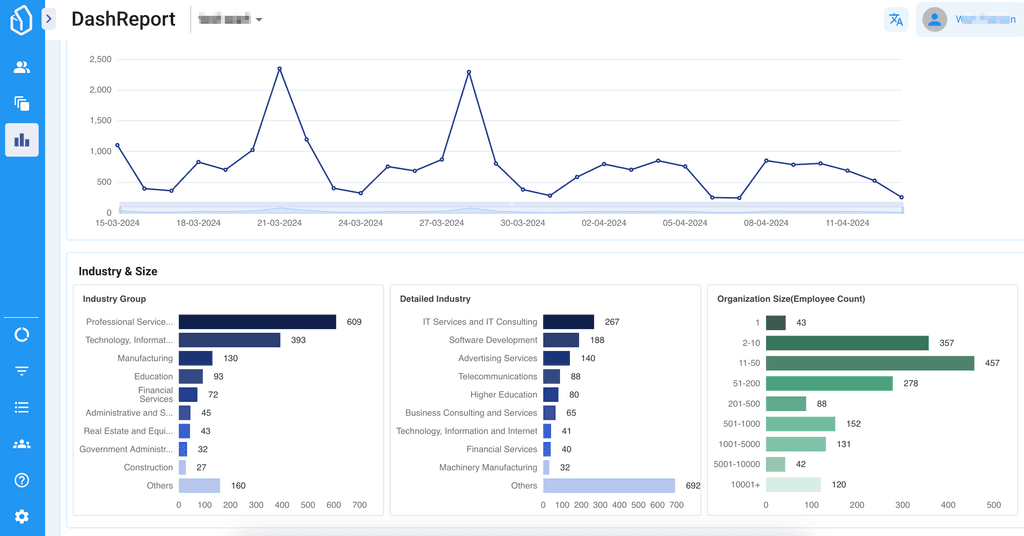

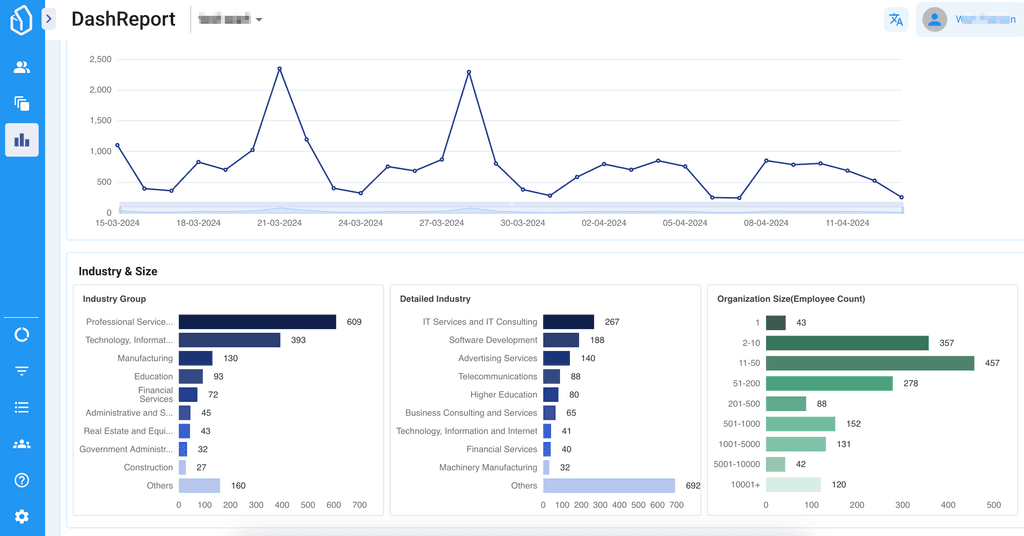

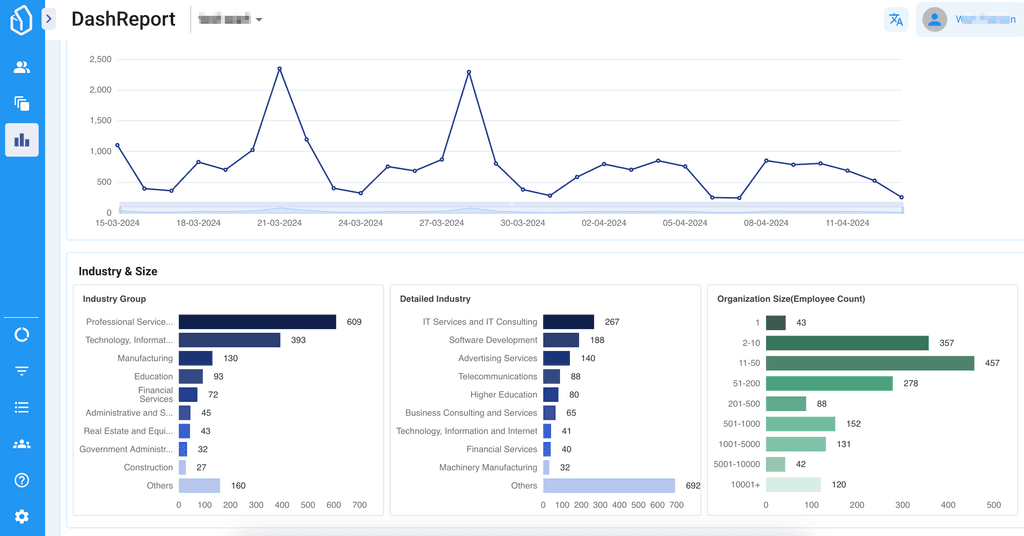

Supercharge your marketing results with LeadBoxer!

Analyze campaigns and traffic, segement by industry, drilldown on company size and filter by location. See your Top pages, top accounts, and many other metrics.

Supercharge your marketing results with LeadBoxer!

Analyze campaigns and traffic, segement by industry, drilldown on company size and filter by location. See your Top pages, top accounts, and many other metrics.

Supercharge your marketing results with LeadBoxer!

Analyze campaigns and traffic, segement by industry, drilldown on company size and filter by location. See your Top pages, top accounts, and many other metrics.

Supercharge your marketing results with LeadBoxer!

Analyze campaigns and traffic, segement by industry, drilldown on company size and filter by location. See your Top pages, top accounts, and many other metrics.